Comapny

Role

Shelf (YC S22)

Product & design (Founding Team)

Here is a video about our MVP to understand the concept

Video made by a freelancer

Insights from current MVP

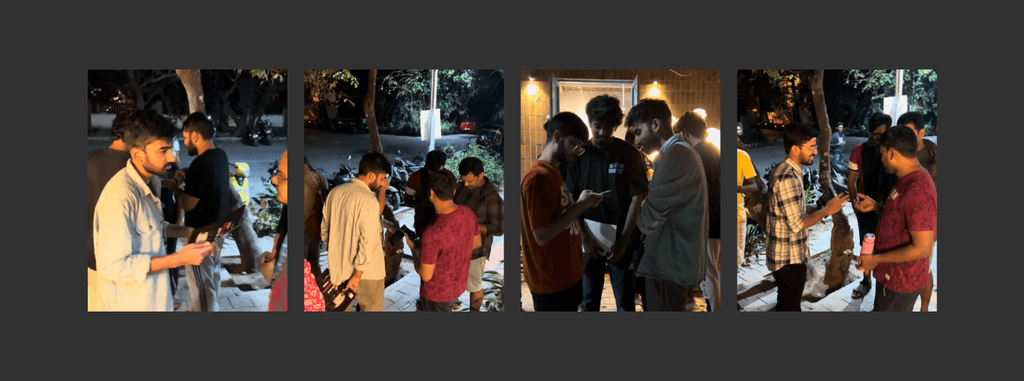

We used to engage with users every Saturday, collaborating with various restaurants to set up stalls and promote special offers. We would interact with interested individuals, helping them understand the offers and assisting in their onboarding process on our app. After onboarding, we would observe how they utilized the app to enhance their experience.

Over 90% of our retained groups consisted of flatmates, primarily due to their daily recurring payments for essentials like groceries.

We also talked with 60+ flatmates groups trying to understand their payment behaviours

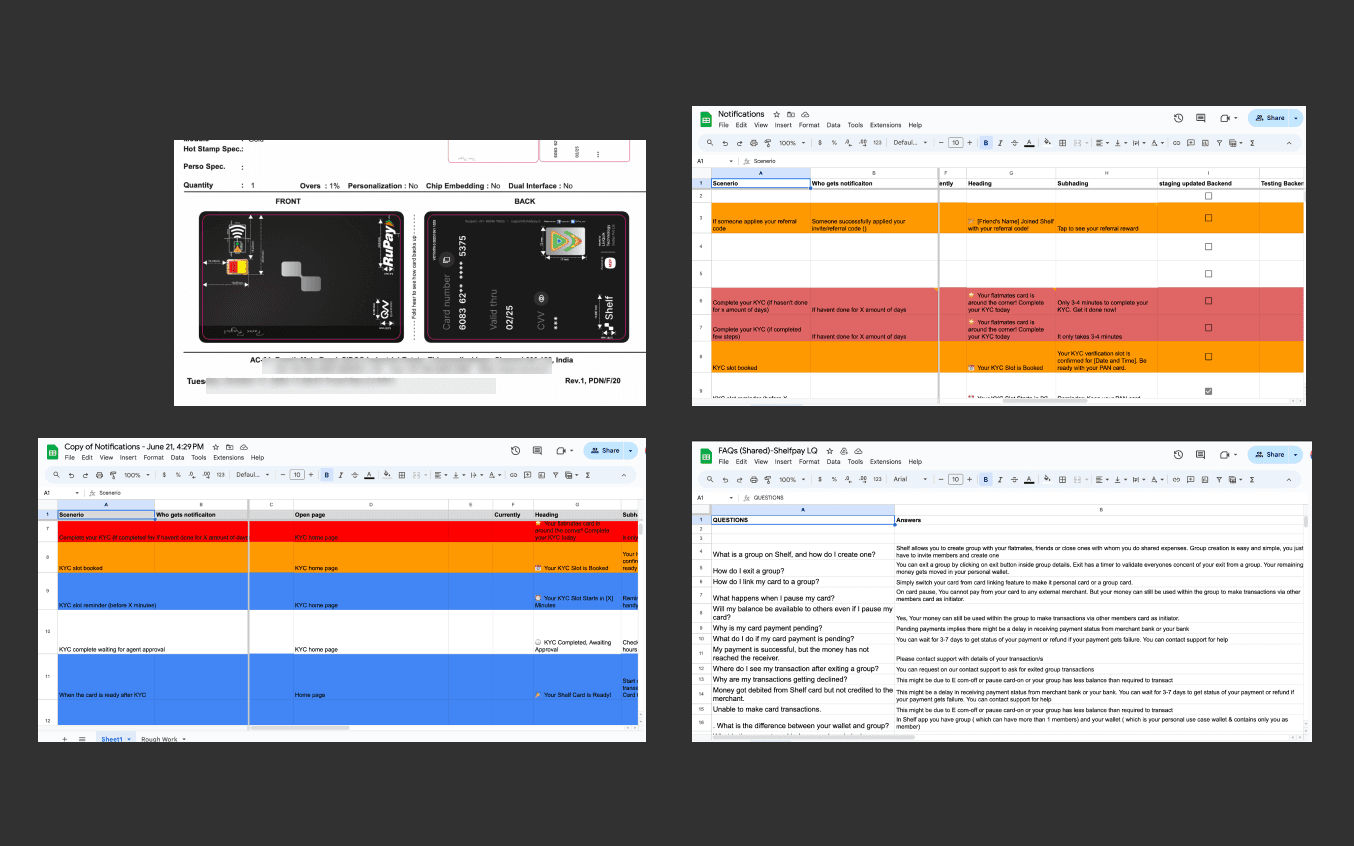

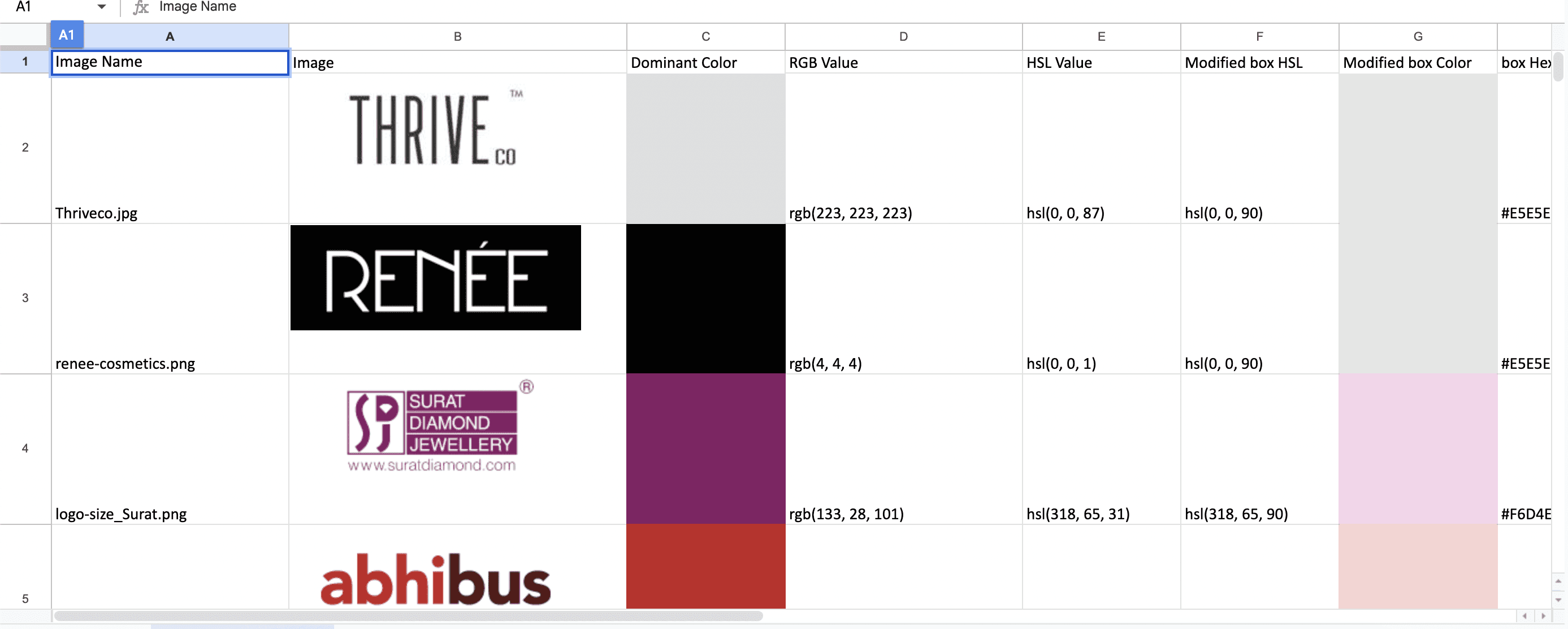

Researching on companies that had launched card products

The key takeaway was that it’s beneficial to niche down into specific categories, as we have observed card products tailored for teens, travelers, college students, and more.

Based on our research, we identified an opportunity to develop a card-based product for flatmates, as they engage in a significant number of high-ticket shared transactions each month.

Even if we target 5,000 flats (which is quite challenging to achieve for a card product) with an average common expense of ₹25,000 per month, this would generate a transaction volume of ₹150 crore, which sounds quite interesting!

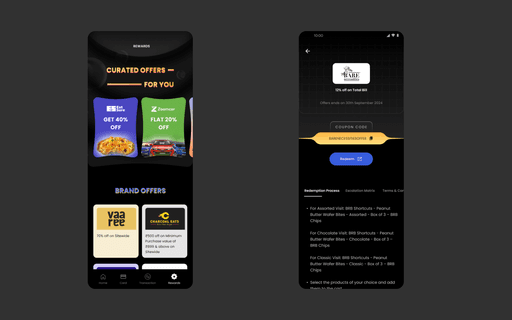

Our initial strategy aimed to generate revenue through interchange fees, while the card also provided an opportunity to offer enhanced rewards and incentives to users.

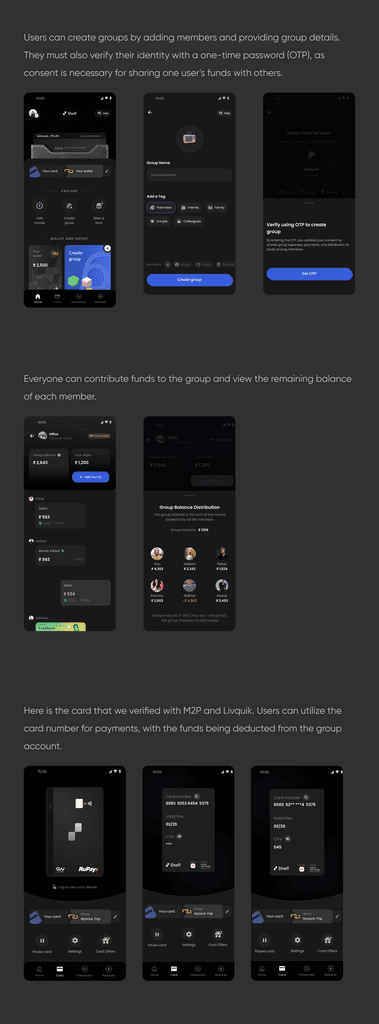

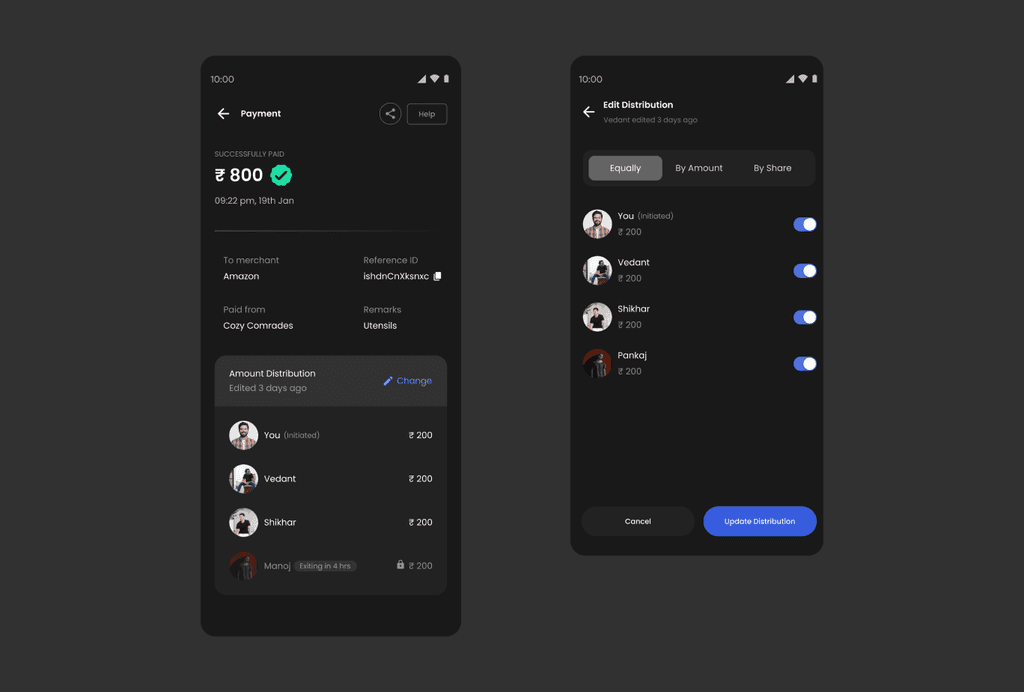

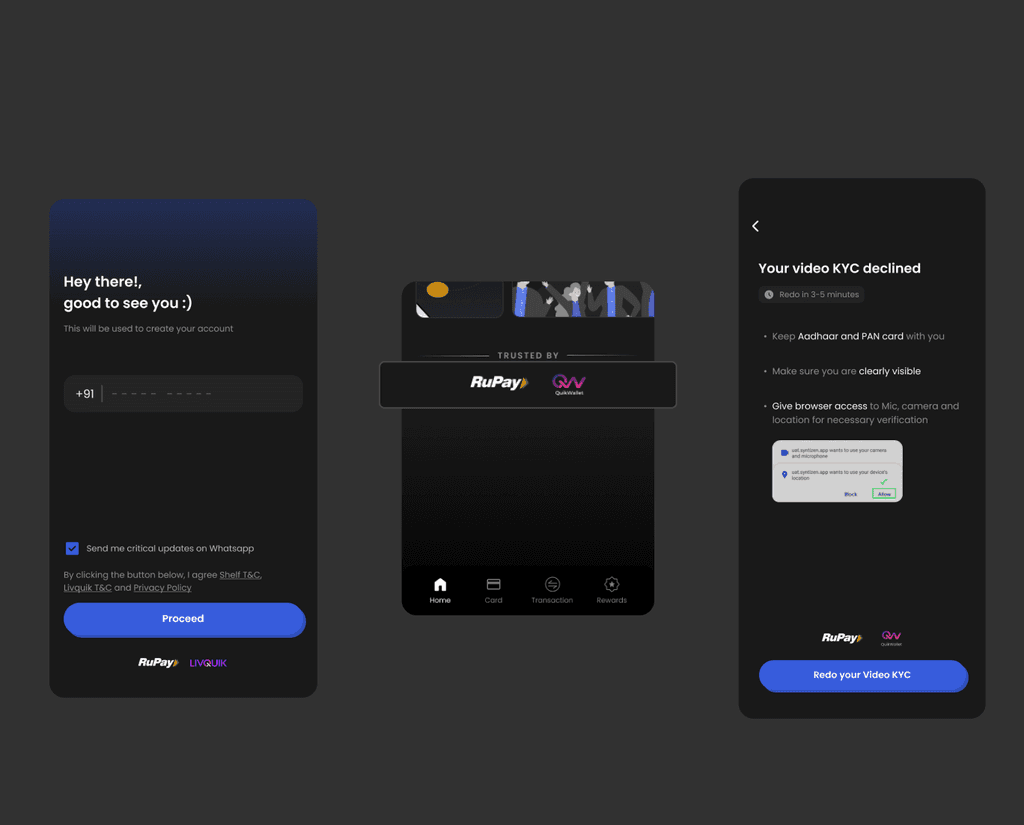

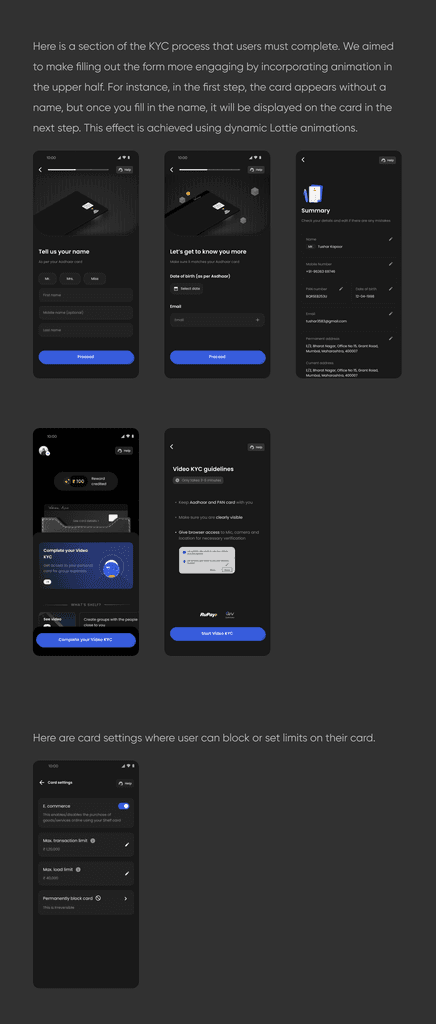

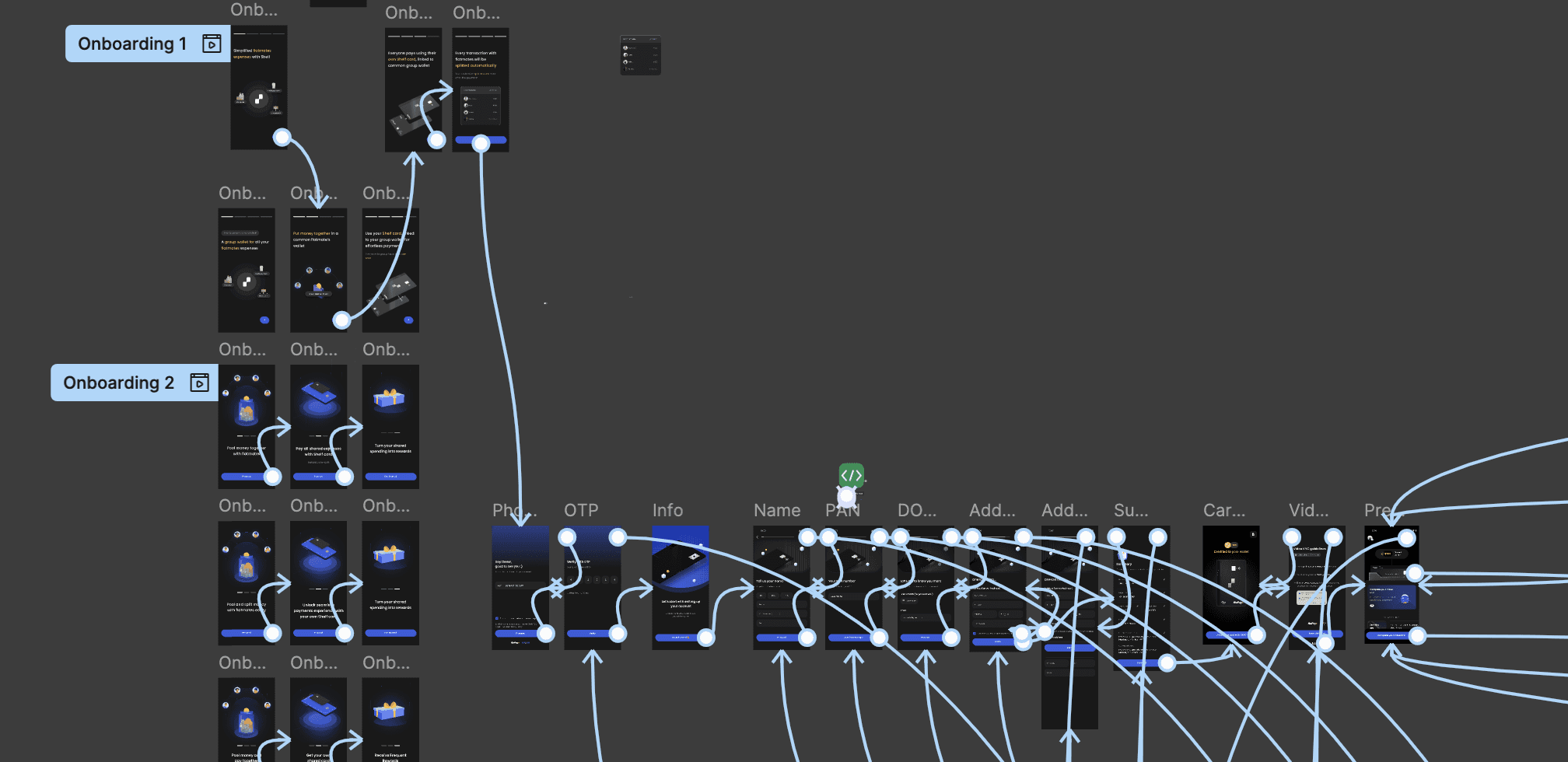

We partnered with M2P and Livquik ( RBI Licensed PPI Issuer) to create a platform that enables flatmates to pool their funds and make payments using a RuPay card.

How can we design a card-based payment solution for flatmates that simplifies shared transactions and allows them to pool funds while tracking their expenses?

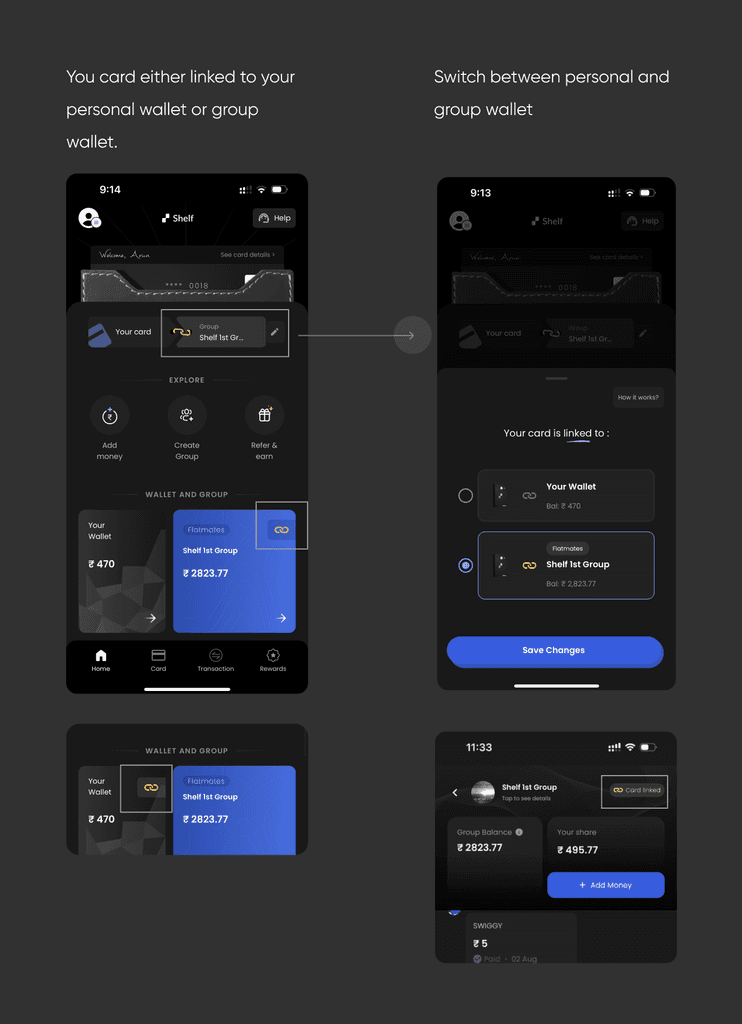

Personal payments vs group payments

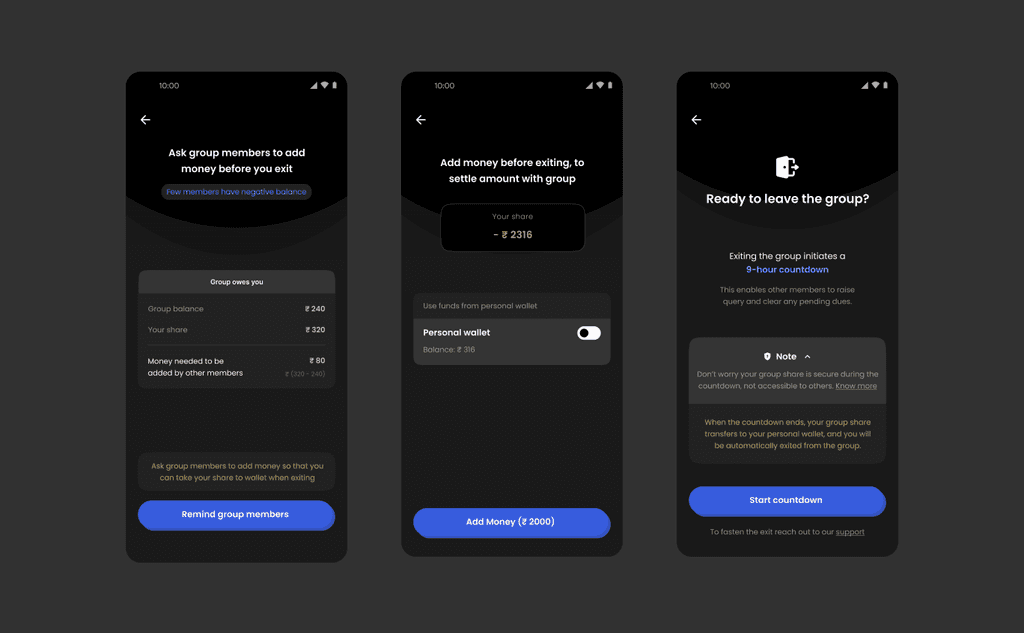

Not all transactions are group payments; users frequently have personal expenses. Once a payment method is saved as a card, they may not want to change it. We should allow users to switch between their personal and group wallets without altering card details. They can connect their card to either wallet, and payments will be deducted from the selected wallet.

On the streets of HSR, we dedicated our evenings to connecting with random flatmates, engaging them in discussions about our app. By exploring different copies and flows, we aimed to evaluate how well they understood the app's concept, gathering insights to enhance our messaging and design.

We are currently gradually rolling out our product to high-intent flatmates who have filled out the waitlist form.

With the limited kits provided by the bank, we have distributed the product to approximately 150 users. This rollout has also involved addressing various compliance issues that arose due to shared payments.